Stamford Land Corporate Ltd

Latest Financials

Condensed Interim Financial Statements For The Six Months And Financial Year Ended 31 March 2025

Financials Archive![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

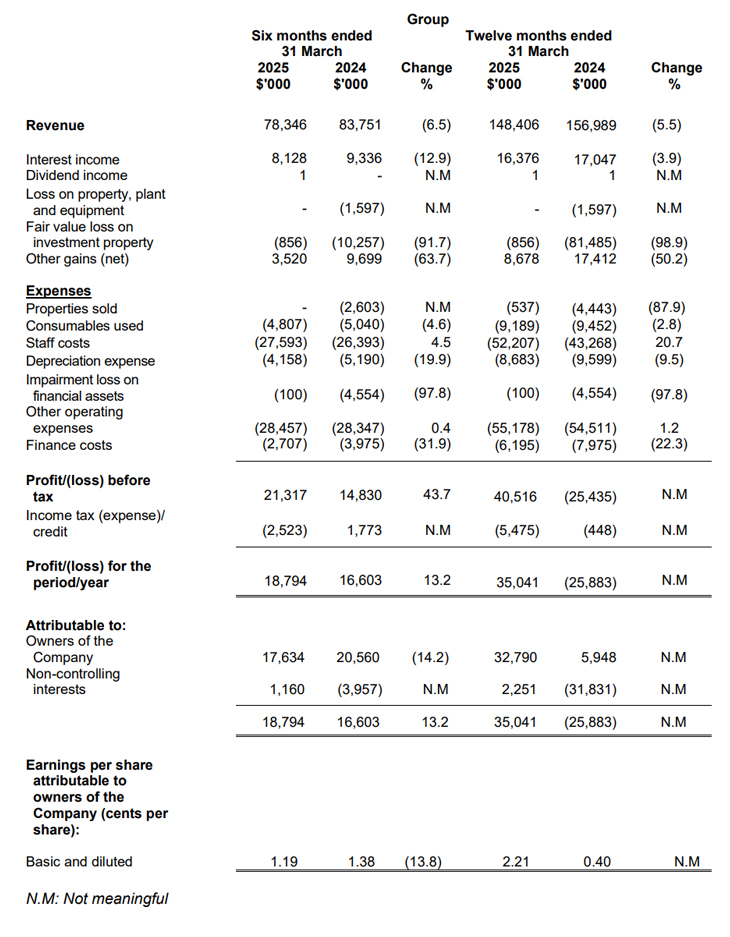

Condensed Interim Consolidated Income Statements For the six months and financial year ended 31 March 2025

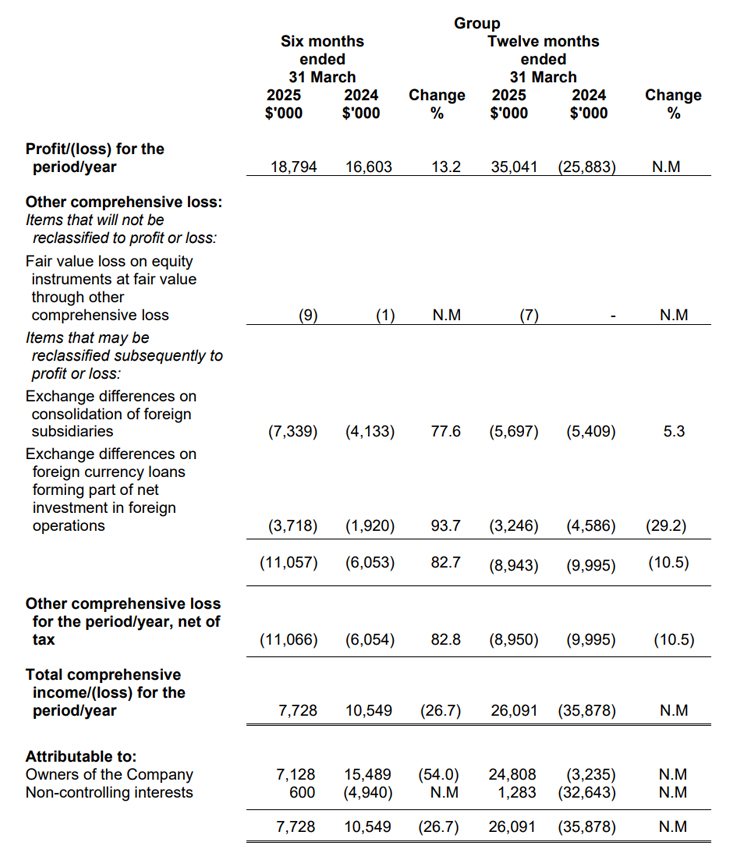

Condensed Interim Consolidated Statements of Comprehensive Income For the six months and financial year ended 31 March 2025

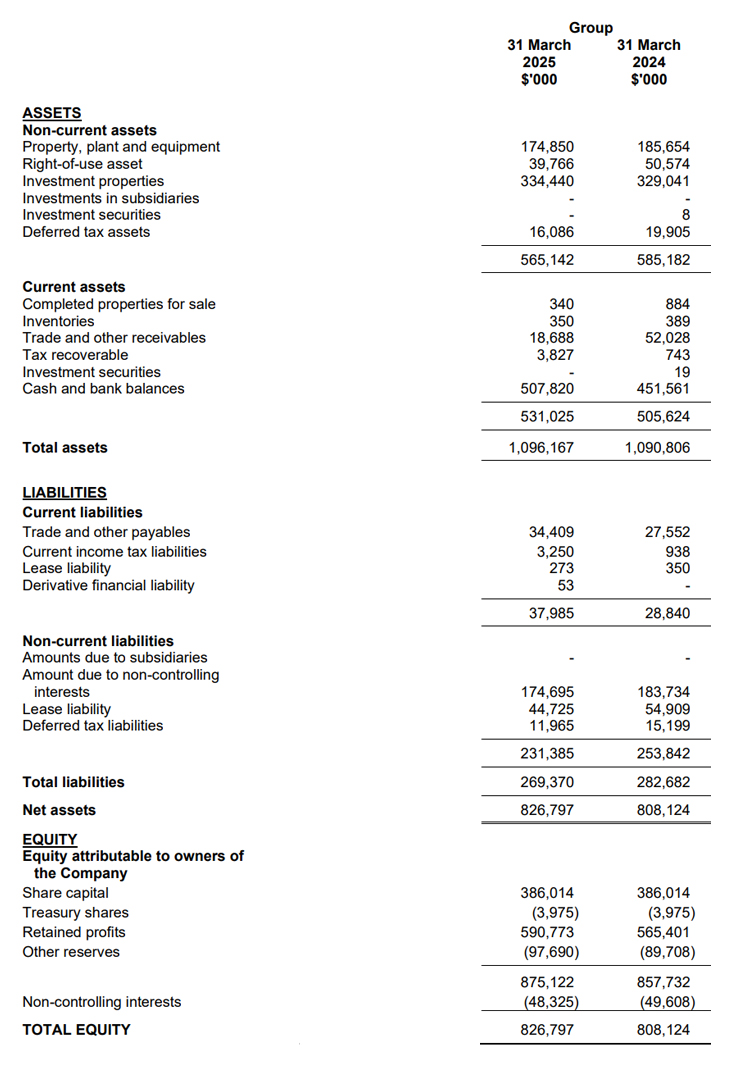

Condensed Interim Balance Sheets As at 31 March 2025

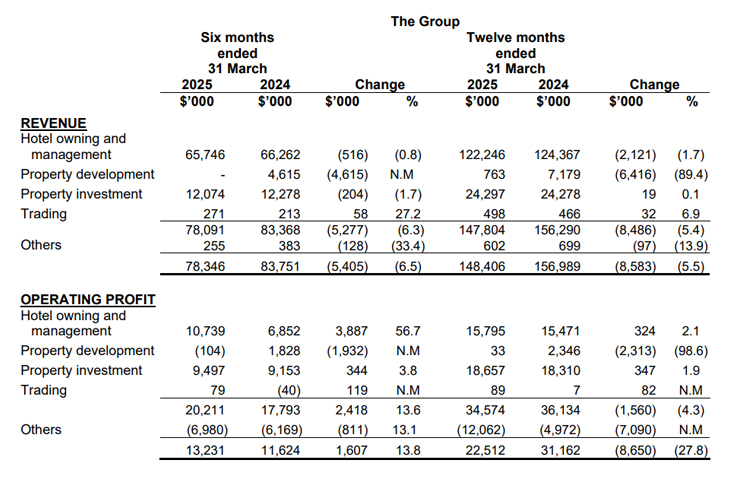

Review Of Performance

Condensed interim consolidated income statements

Hotel owning and management

- The lower revenue and operating profit was mainly due to lower room rates in our hotels caused by softer market, including depreciating Australian dollar against Singapore dollar.

- The higher operation cost was due to increased property taxes, staff cost, energy costs and other direct cost.

Property development

- During the twelve months ended 31 March 2025, 1 unit in Macquarie Park Village was settled, compared to 10 units during the twelve months ended 31 March 2024.

Property investment

- The revenue and operating profit for the twelve months ended 31 March 2025 remains stable. The slight increase was mainly due to appreciation of the Sterling Pound against the Singapore Dollar, especially during the last quarter of the financial year.

Others

- The lower operating profit for the twelve months ended 31 March 2025 was mainly due general increase in staff cost and accrual of the incentives payments contrary to a reversal of S$5 million in the prior year.

Condensed interim consolidated balance sheets

The local government has reduced the land value which was the basis used to determine the amount of land lease payments for a hotel property. This has resulted the Group to remeasure the right-of-use assets and lease liability based on reduced land lease payment.

Condensed interim consolidated statements of cash flows

The Group recorded an increase in cash and bank balances of S$56.3 million in the twelve months ended 31 March 2025, mainly due to:

- cash inflows from operating activities,

- full repayment of a vendor financed loan granted to purchaser of Dynons Plaza, in Perth, Australia, and

- partially off-set by the repayment of interest to non-controlling interest and dividend paid to shareholders.

Commentary

- Global trade continues to be fragmented and uncertain amid rising tariffs and trade war. The hotels continue to face formidable competition, coupled with rising operating and manpower costs, and a tight labour market.

- The commercial tenancy situation for the Group’s property in London remains stable and fully tenanted.

- At present, there are no compelling acquisition opportunities offering sufficiently attractive yields to justify the associated investment risks. In the interim, surplus cash is prudently placed with reputable financial institutions while we continue to monitor the market for appropriate opportunities.

- In the meantime, we have invested close to S$3 million on restoration works to the heritage-listed building at Stamford Plaza Brisbane, in compliance with requirements set by the State Government of Queensland. Concurrently, we are in negotiations to extend the existing lease and to secure redevelopment approvals.

- The Company raised net proceeds amounting to S$238.9 million from the Rights Issue in February 2022. As at 31 March 2025, S$146.0 million (31 March 2024: S$144.2 million) has been utilised.